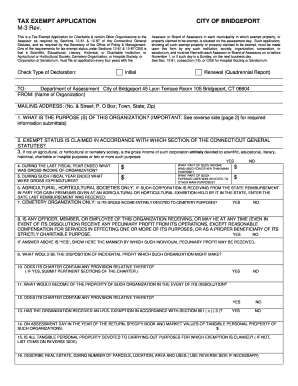

ct sales tax exemption form

Over 300 stakeholders are membersadvisors to the Council including business leaders educators philanthropic and community-based organizations. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now.

For other Connecticut sales tax exemption certificates go here.

. For a complete list of exemptions from Connecticut sales taxes refer to Conn. An organization that was issued a federal Determination Letter of exemption under Section 50lc3 or 13 of the Internal Revenue Code is a qualifying organization for the purposes of the exemption from sales and use taxes. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

Application for Registration Agricultural Sales and Use Tax Certificate of Exemption. Sales Tax Exemptions in Connecticut Several exemptions are certain types of safety gear some types of groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent light. 2021 Connecticut Sales Tax Free Week.

Connecticut State Department of Revenue Services. Farmers with a current exemption permit will receive a renewal package. How to use sales tax exemption certificates in Connecticut.

Machinery Component Parts and Replacement and Repair Parts of Machinery Used Directly in a. Application for Exemption from Sales Tax for Interstate Telecommunications in the Operation of a. Exemption from sales tax for services rendered between parent companies and wholly-owned subsidiaries.

Ct tax-exempt form 119. Ct sales and use tax form. Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption.

Retailers purchasing goods for resale are not subject to Connecticuts sales tax. Scaling to meet industry-wide needs. Dry Cleaning Establishment Form.

It is the sellers responsibility to keep this certificate as proof of tax-exempt status. Responding to urgent workforce requirements. Sales tax relief for sellers of meals.

Other Sales and Use Tax Forms. Health Care Provider User Fees. 2022 Connecticut state sales tax.

Sales of goods and services to Connecticut credit unions beginning July 1 2016 12-412 121 MOTOR VEHICLES AIRCRAFT AND BOATS. Amending a Sales and Use Tax Return. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations.

Otherwise exempt organizations are not allowed to purchase tangible. Complete Edit or Print Tax Forms Instantly. Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax.

The event must be exempt from tax under Conn. A qualifying exempt organization may use this certificate to purchase any tangible personal property for resale at one of five fund-raising or social events of a days duration during any calendar year. This is not a complete list of exemptions but it does include purchases commonly made by individual consumers.

Texas Comptroller of Public Accounts. Training and funding provided by state and local agencies educational institutions private companies others. Page 1 of 1.

Department of Revenue Services. Ct tax-exempt form 119. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635.

Ct sales tax exemptions. Sales Tax Exemptions in Connecticut. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Counties and cities are not allowed to collect. If approved form OR-248 Agricultural Sales Tax Exemption Permit is issued.

Ct tax exempt form for nonprofit. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Ad Access Tax Forms.

Such retailers are supposed to submit resale exemption certificates to the sellers. Sales Tax Exemptions in Connecticut. Ad Instantly apply and receive the proper tax resale certificate your business.

SalesTaxHandbook has an additional five Connecticut sales tax certificates that you may need. Factors determining effective date thereof. Sales Tax Relief for Sellers of Meals.

Rental Surcharge Annual Report. Real and Personal Property Tax Exemptions. Application for Sales and Use Tax Exempt Entities or State and Federally Chartered Credit Unions.

Application for Pollution Control Sales and Use Tax Exemption. Department of Revenue Services. How to create an eSignature for the worksheet connecticut ctdol.

Click here to learn more. April 2022 Connecticut Sales and Use TaxFree Week. This certificate shall be part of each order which we may hereafter give to you unless otherwise specified and shall be valid until.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Materials tools fuels machinery and equipment used in manufacturing that are not otherwise eligible for a sales tax exemption 50 of the gross receipts from such items 12-412i. Manufacturing Machinery and Equipment Tax Exemption Learn about a five-year 100 property tax exemption for manufacturers buying eligible equipment.

Create this form in 5 minutes. Download Or Email CT DRS More Fillable Forms Register and Subscribe Now. Make it subject to a sales or use tax we will pay the tax due direct to the proper taxing authority when state law so provides or inform the seller for added tax billing.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Exemption permits must be renewed every two years. Applicable to certain services prior to June 30 1987.

Go Paperless Fill Sign Documents Electronically. This page discusses various sales tax exemptions in Connecticut. Services Subject to Sales and Use Taxes.

For other Connecticut sales tax exemption certificates go here. Cetification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Exemption from sales tax for items purchased with federal food stamp coupons.

Business Use Tax Returns. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. Get access to thousands of forms.

Exemptions from Sales and Use Taxes. The following is a list of items that are exempt from Connecticut sales and use taxes. Use US Legal Forms to find the Connecticut Self-Employed Paving Services Contract with a few mouse clicks.

For example an exemption permit issued in 2014 is valid from October 1 or the date it is issued whichever is later until September 30 2016. This Certification is necessary to determine whether the sale or exchange should be reported to the Seller and to the Internal Revenue Service on Form 1099-S Proceeds from Real Estate Transactions. Fill out a simple online application now and receive yours in under 5 days.

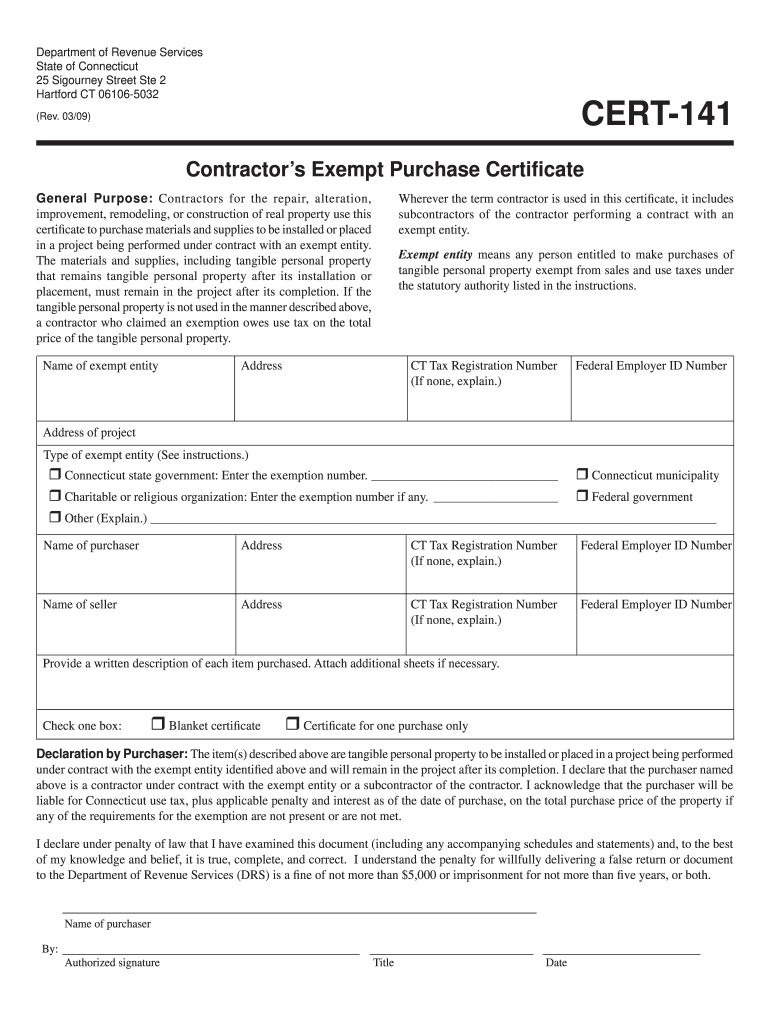

Exact tax amount may vary for different items. Use professional pre-built templates to fill in and sign documents online faster. This ia a Contractor Sales Tax Certificate which is a special type of certificate intended for use by contractors who are purchasing goods or tools that will be used in a project contracted by a tax-exempt entity like a government agency or tax-exempt nonprofitThe contractor must certify that the goods being purchased tax-free are exclusively for use on the tax-exempt entitys contract.

Admissions and Dues Taxes Form. Renewal of Your Sales Tax Permit.

Form Reg 8 Fillable Farmer Tax Exemption Permit

Businessusetaxexemptform Motion Raceworks

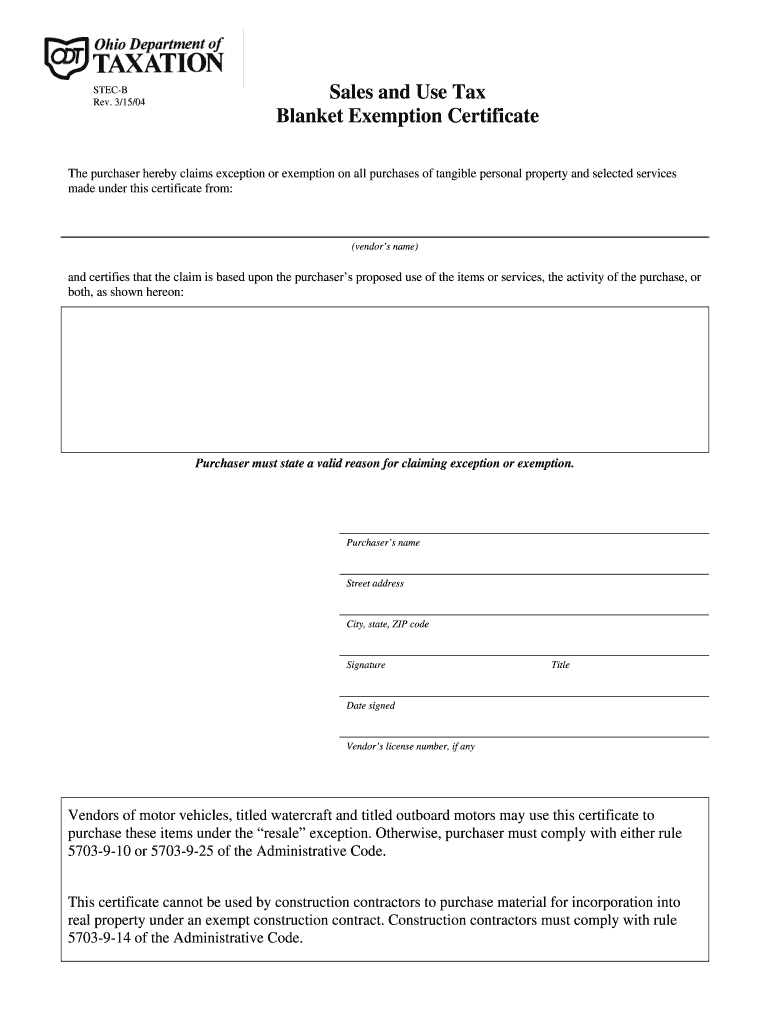

Tax Exempt Form Ohio Fill Online Printable Fillable Blank Pdffiller

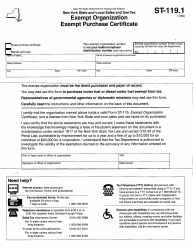

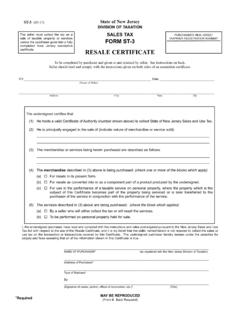

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

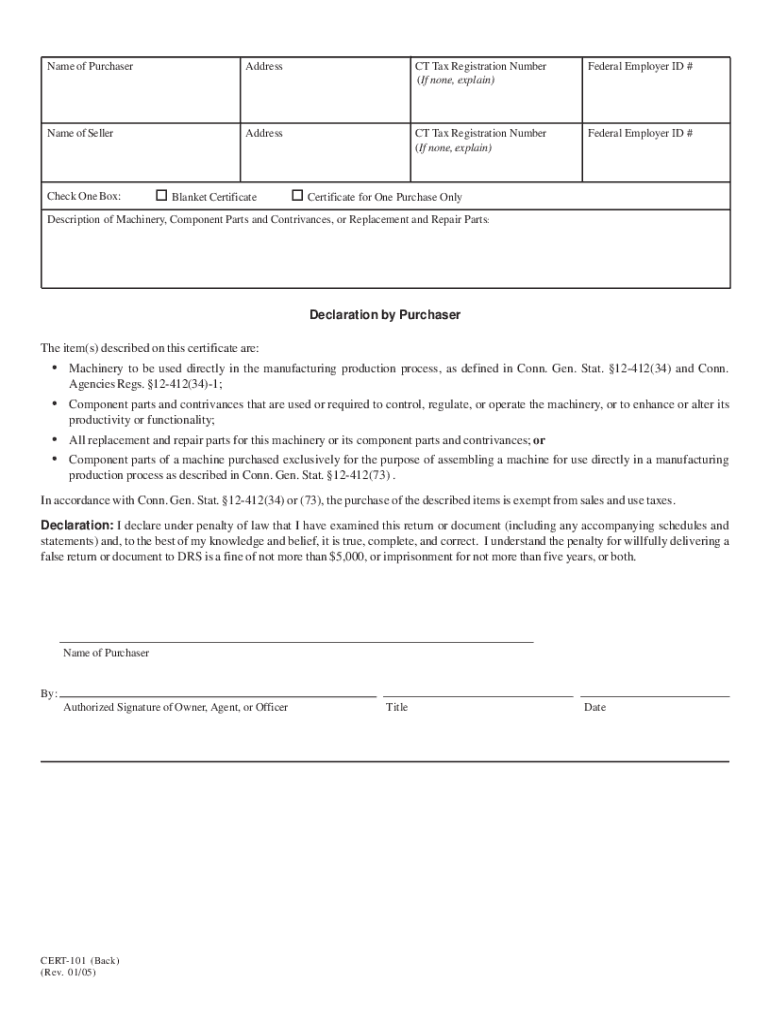

Cert 101 Fill Online Printable Fillable Blank Pdffiller

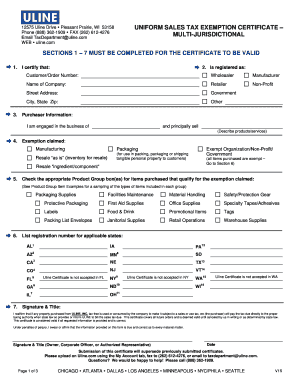

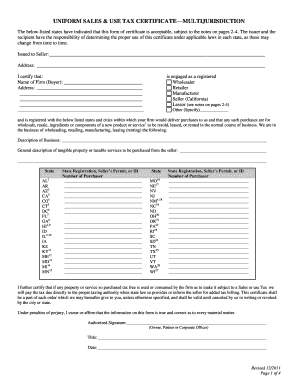

Fillable Multi Jurisdictional Tax Form Fill Online Printable Fillable Blank Pdffiller

King Soopers Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

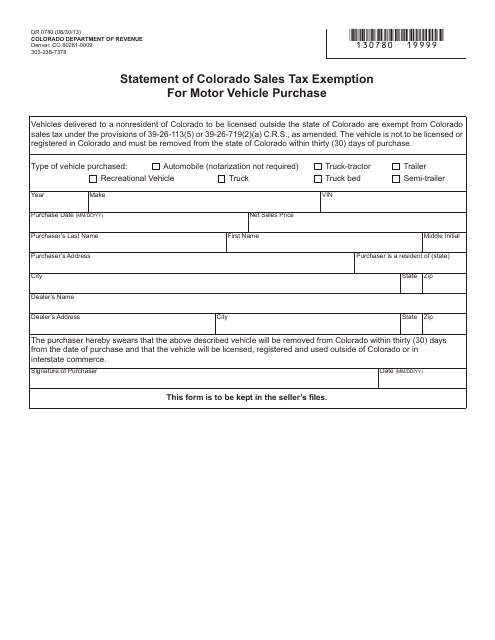

Form Dr0780 Download Fillable Pdf Or Fill Online Statement Of Colorado Sales Tax Exemption For Motor Vehicle Purchase Colorado Templateroller

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

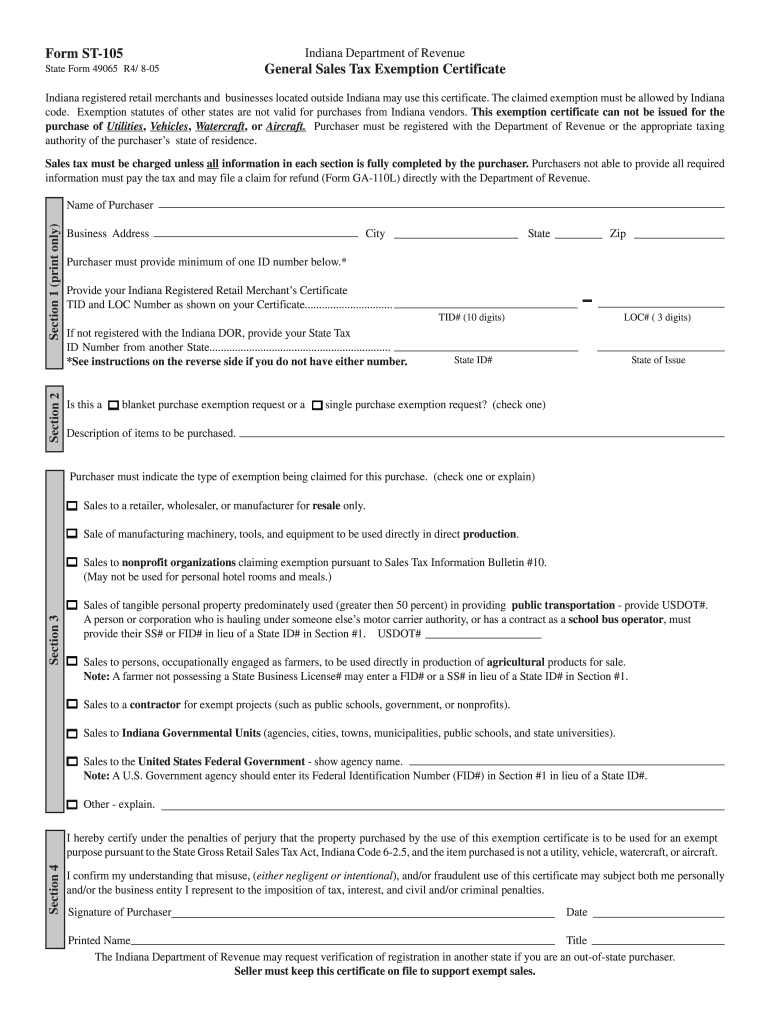

St 105 Fill Online Printable Fillable Blank Pdffiller

Fillable Multi Jurisdictional Resale Certificate Form Fill Out And Sign Printable Pdf Template Signnow

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Sales Tax Form St 3 New Jersey Resale Certificate Pdf4pro